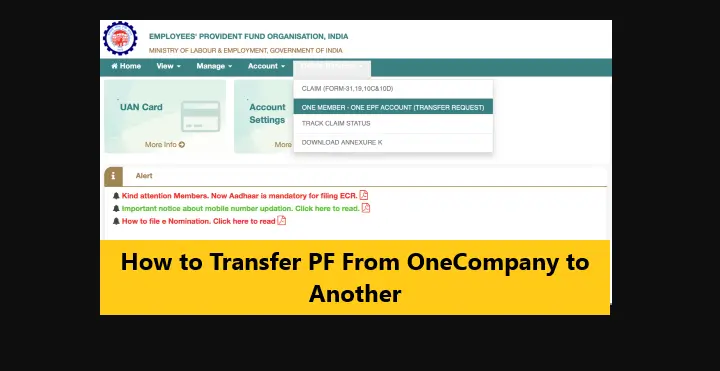

How to Transfer PF From OneCompany to Another.

If you’re switching companies and want to transfer your PF balance to your new employer, follow these steps for a smooth transition:

- Understand the Benefits: Transferring your PF balance rather than withdrawing it helps increase your retirement savings and is tax-efficient. Withdrawing PF funds within five years of continuous service incurs taxation.

- Access Your EPF Account: Sign in to your EPF account using your UAN and password here.

- Initiate Transfer Request: In the ‘Online Services’ section, select ‘One Member – One EPF Account (Transfer Request)’.

- Review Personal Information: Carefully review your personal details and current PF account information.

- Retrieve Previous Employment Details: Click on ‘Get Details’ to retrieve information about your previous PF account.

- Attestation: Depending on your preference and DSC approval, self-attest the claim form or have it attested by your previous or current employer.

- Enter Employer Details: Select the relevant employer and enter your Member ID or UAN in the provided fields.

- OTP Verification: Click on ‘Get OTP’ to receive a one-time password (OTP) on your registered mobile number. Enter the OTP to validate your identity and click ‘Submit’.

- Transfer Request Form: Once validated, an online PF transfer request form will be generated. Self-attest this form and send it in PDF format to your chosen employer.

- Employer Notification: Your employer will receive an online notification regarding the EPF transfer request.

Following these steps ensures a seamless transfer of your PF balance to your new employer, safeguarding your retirement savings.

Note: The information above might not be accepted 100%. Please verify from your own sources. We will not be responsible for any kind of loss due to our content.

For more news, please visit Munafa Marketing.