SBP Names Banks Responsible for Increase in US Dollar Rates.

The State Bank of Pakistan (SBP) has revealed the involvement of prominent banks, including Habib Bank, Allied Bank, Bank Alfalah, UBL, MCB Bank, Bank Al Habib, Meezan Bank, NBP, Askari Bank, and Habib Metropolitan Bank, in a significant surge in the US dollar rate.

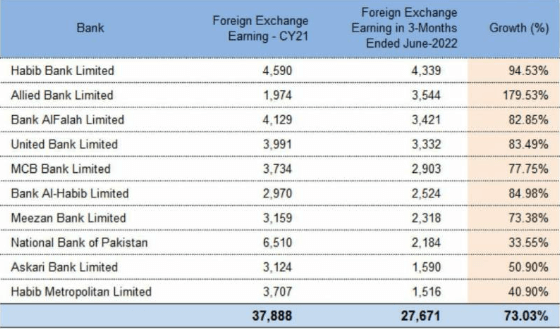

These banks reportedly earned a staggering profit of Rs27.8 billion on foreign exchange in the first quarter of fiscal year 2022-23, surpassing their entire profits for 2021-22. Speculations suggest more banks may surface in the ongoing scandal.

In a startling revelation, it was found that during the first three months of 2022, Allied Bank experienced a 79.55% increase in income from foreign exchange compared to the entire year of 2021.

Similarly, HBL recorded a 94.55% increase in foreign exchange income in the same period compared to the entire year of 2021.

Read More: Forex SBP Reserves Fall by $115mn Below $7.4 Billion

Despite the oversight responsibility lying with the SBP and Pakistan’s Finance Ministry, the regulatory bodies allegedly failed to effectively regulate these banks, contributing to the surge in the US dollar rate.

The situation intensified after a regime change in the country, leading to the outflow of the US dollar.

The new Finance Minister, Ishaq Dar, has committed to reducing the US dollar rate below Rs200.

Read More: Roshan Digital Account Brings Record $6.9 Billion Remittances in October

However, a fair analysis suggests that the rate should ideally be around Rs190 or Rs195. The ground reality, as it stands, contradicts these expectations. It is pertinent to mention that dollar rates directly affect the economy of Pakistan.

Note: The information above might not be accepted 100%. Please verify from your own sources. We will not be responsible for any kind of loss due to our content.

For more news, please visit Munafa Marketing.