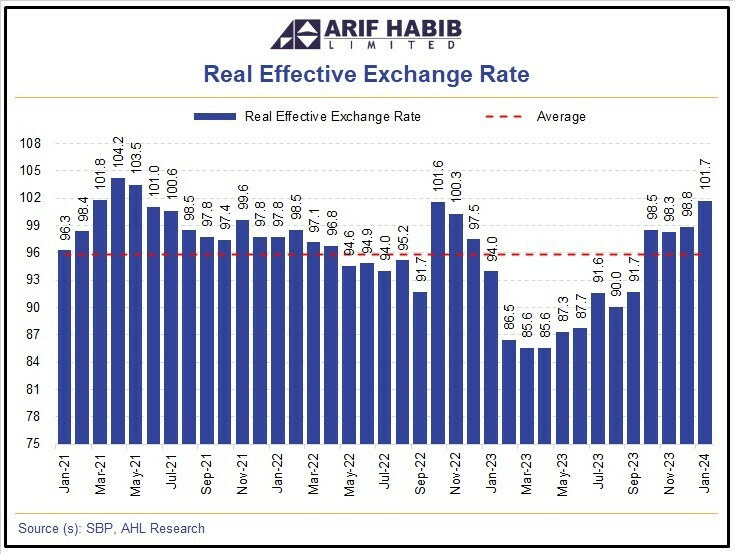

Pakistan’s REER Index Hikes to 101.7 in January 2024.

According to data released by the State Bank of Pakistan (SBP) on Monday, Pakistan’s Real Effective Exchange Rate (REER), a gauge of currency value against a basket of foreign currencies, rose to 101.70 in January 2024, up from 98.83 in December 2023.

A REER below 100 indicates competitive exports and expensive imports, while a value above 100 suggests the opposite. The recent uptick in REER signals a decline in trade competitiveness.

The SBP’s latest figures reveal a 2.9% month-on-month increase in REER for January 2024. Compared to January 2023, the REER has surged by 8.23%, reaching 93.96.

This January’s REER figure marks the highest since May 2021, as noted by brokerage firm Arif Habib Limited.

According to the State Bank of Pakistan (SBP), a REER index of 100 doesn’t signify the currency’s equilibrium value but rather indicates changes relative to its average in 2010.

The Nominal Effective Exchange Rate Index (NEER) rose by 1.25% month-on-month (MoM) in January 2024 to a provisional value of 38.41, compared to 37.94 in December 2023. Yearly, the NEER index dropped by 13.60% from January 2023’s value of 44.46.

REER, as defined by the central bank, is an index comparing the price of a basket of goods in one country to the price of the same basket in its major trading partners.

This comparison is made using the nominal exchange rate with each trading partner, with the price of each partner’s basket weighted by its share in imports, exports, or total foreign trade, as detailed on the SBP website.

Note: The information above might not be accepted 100%. Please verify from your own sources. We will not be responsible for any kind of loss due to our content.

For more news, please visit Munafa Marketing.