Oct 31st new deadline to file tax returns, providing an opportunity for those who did not file their returns before October 14.

ISLAMABAD: The government on Tuesday extended the deadline for filing of income tax returns for tax year 2024 until October 31, providing a chance to those who could not file their returns before October 14.

Income Tax Return Deadline Extended to October 31, 2024

The previous deadline was October 14, but banks in Islamabad and Rawalpindi were closed for three days, causing problems for taxpayers who completed their returns, Federal Board of Revenue (FBR) Chairman Rashid Mahmood Langrial confirmed to Dawn on Monday.

The original deadline for submittal of tax returns was September 30 under the income tax ordinance.

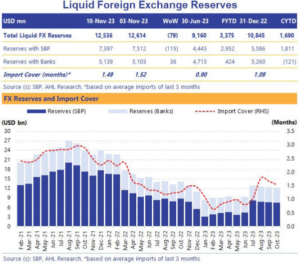

The FBR received 4.537 million income-tax returns up to October 14, which were 107.83 per cent higher compared to 2.183m during the same period last year. It received a total of 6.464m returns for the tax year 2023. To reach last year’s level, it anticipates an additional 1.927m returns.

Preliminary data shows that, between July 1, 2023 and October 14, 2024 the FBR has so far had a total number of 1.059m new return filers entering the tax system with 463,029 new filers inducted between July 1, 2023 and October 14, 2024.

Nil-filers: Oct 31st new deadline to file tax returns

Total returns have skyrocketed as a multiple of last year’s but nil-filers have also skyrocketed in tax year 2024. Returns are quite frequently filed to record the onetime financial dealing or get entry into the lower tax brackets for laying it up in the Active Taxpayer List or ATL.

FBR reports say tax returns are up, but nil-filers on rise

From July 1, 2024, to October 14, 2024, 1.679 million nil-filers accounted for 37pc of total returns lodged for this period. For tax year 2023, there were 783,816 nil-filers, which represented 35.86pc of total returns filed, at 2.183 million.

Total returns submitted for the year 2023 tax year totaled 6.464m, with 3.508m being nil-returns accounted for at 54.26pc. The figures show that from July 1, 2023 to October 14, 2024, new return filers stands at 1.059m, of which 636,961 are records of nil-filers. The NIL return trend continued into the tax year 2024, with 463,029 new returns having filed since July 1, 2024. NIL return was 315,650.

To reverse this trend, the government has agreed to scrap the nil-filer and notional-filer categories that are, in fact, considered nil-filers. The notional filers only file returns to be eligible for reduced tax rates as they don’t pay their taxes. Therefore, the government finds it quite challenging to single out people who are not paying their taxes.

Tax payments: Oct 31st new deadline to file tax returns

Tax payments related to returns for tax year 2024 reached Rs119.077 billion up to October 14, against the amount of Rs52.202 billion, up by 128pc of the amount collected during the corresponding period last year.

The sizeable payment helped the FBR post revenue collection target for September 2024.

Under FBR transformation plan, it is proposed to prohibit non filers from carrying on financial as well as investment business activities except Haj/Ziarat trips.

The proposed measures of three income declared tiers: Non- filers can neither purchase cars nor immovable property nor financial instruments nor open bank accounts except opening Asaan Account.

Oct 31st new deadline to file tax returns, so huryy up!

Note: The information above might not be accepted 100%. Please verify from your own sources. We will not be responsible for any kind of loss due to our content.

For more news, please visit Munafa Marketing.