FBR issues statement on income tax return filing deadline

FBR Urges Taxpayers to File Returns by September 30th

Federal Board of Revenue (FBR) clearly states that the deadline for filing income tax returns in Pakistan is still set at September 30th, 2024.

Read More: How to File FBR Income Tax Returns: Detailed Guide 2024

No relaxation would be provided, and actions would be taken against those who don’t adhere.

Time’s running out, too. File a return now.

The FBR urged all the taxpayers to file their income tax returns as soon as possible with the deadline nearing.

Here’s what you need to know:

Last day to file your income tax return is an absolute September 30th, 2024. Don’t delay any more and avoid penalties.

- Penalties for Non-Filers: The FBR has issued stern warnings to those who will not comply before the deadline.

The actions may include:

- Cut-off of facilities, including mobile SIMs, electricity, and gas connections.

- Freezing of bank accounts.

- Legal action against habitual non-compliance.

Expansion of Tax-Benefit Network

The news is good despite the looming deadline. Thus far, more than 1.9 million returns have been filed under income tax.

These include:

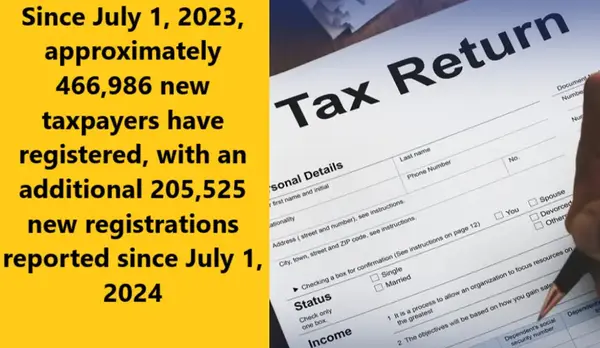

- Surge in New Registrations: Since 1 July 2023, more than 466,986 new taxpayers have registered. This even carried over into 2024 with the registration of another 205,525.

- Taxpayer Compliance on the Rise: The surge in the number of registrants is an increased acknowledgement and compliance practice due to the FBR’s campaigns and enforcement actions.

The FBR statistics also illustrate a growth trend in tax compliance and the number indicates a level of nearly six million returns for 2023.

The most ambitious task is to broaden the tax net so that more people come within the formal tax net

Who Needs to File?

To clear up confusion on income tax return filing requirements, the FBR has made announcements with regards to who needs to file:

- Over Rs.600,000 per annum income earners: All those people whose annual income exceeds Rs.600,000 would be required to submit their return.

- Property or vehicle owner: Even a property or a vehicle owner should submit his or her income tax return.

- Entrepreneurs: Any entrepreneur, who has earned much more than the required amount, has to send his or her return.

- Foreign Travel or Bank Balances: If you have any record of foreign travel or have bank balances over PKR 50,000 then you come in the category of people, who file return.

File Your Return: FBR issues statement on income tax return filing deadline

FBR website Click Here is the source, which provides all the tools and information you need for filing your income tax return online. Many tax consultants and online portals guide you through this process as well.

Remember: filing your income tax return before the due date is not only a legal requirement but also a payback to Pakistan’s development process as you are playing your role in forming a stronger, prosperous future of the country.

So, don’t wait! File your income tax return before 30th September and nothing should be dreaded because no penalty will be inferred from the returned tax date.

Note: The information above might not be accepted 100%. Please verify from your own sources. We will not be responsible for any kind of loss due to our content.

For more news, please visit Munafa Marketing.